Historically, the two known ways to exchange cryptocurrencies were either by directly sending them to the person you are trading with, or using a centralized exchange. The former requires you to trust the person you are trading with due to the lack of a mediator. A centralized exchange requires your trust as well — because the exchange will have custody of your tokens — the exchange is the mediator.

Using an exchange that is in custody of your tokens presents the risk of censorship, and the risk of your funds being stolen from the exchange (often via weaknesses in the login mechanism or the administrative tools used on the back-end to assist customers). The exchange might also do an ‘exit scam’ and steal customers’ tokens.

Running a centralized exchange also carries the responsibility of providing liquidity. Decentralized exchanges (DEX) such as QuickSwap avoid this issue by allowing everyday people to provide liquidity — even in tiny amounts. This enables absolutely anyone to earn liquidity provider (LP) fees that generate a passive income. This provides an easy way to make money.

Being able to do this without having to go through a bank’s unpleasant registration process (and after all that, you will only be paid a low interest rate) is a significant milestone. With regards to trading, a DEX acts as the mediator — except it is unbiased and isn’t a custodian. QuickSwap utilizes the Ethereum blockchain and a Layer 2 (L2) scaling solution called Polygon.

Ethereum is a decentralized network of thousands of computers — each of which maintains a copy of its blockchain and protects the integrity of the network and the software running on it (the software running on it is referred to as dApps). Polygon’s role in this case is to reduce fees and increase the speed of dApps running on Ethereum. QuickSwap is one of these dApps.

Learn what Ethereum is and more about how it works.

How QuickSwap Works

QuickSwap is a set of smart contracts that enables people to submit buy or sell orders for cryptocurrencies via your browser without signing up or providing any personal information. A smart contract is a computer program that is executed by the Ethereum Virtual Machine (EVM). Smart contracts handle the token swaps — not a person or a corporation.

QuickSwap is capable of exchanging tokens that are on the Polygon Network. Many have already implemented support for it. However, there are also wrapped tokens (these token symbols are often prefixed by a W) such as WETH (Wrapped ETH), WBTC (Wrapped BTC), stablecoins such as USDC and DAI which are pegged to the value of the US dollar, among many others.

If you choose to go ahead with a trade on QuickSwap, your browser-based wallet (for example: MetaMask) will send the tokens you are selling to a QuickSwap smart contract and it will fill your order if someone else is selling the tokens that you want in return. If the order is filled, it will send the tokens you opted to trade for to your wallet (the same one used to send the tokens you’re selling).

Under such a scenario, there is enough liquidity. If this is not the case, it will display an error saying ‘Insufficient liquidity for this trade’.

The QuickSwap Fork

QuickSwap was forked from the Uniswap project last year. Uniswap is the largest decentralized exchange on Ethereum, and the 4th largest decentralized finance (DeFi) dApp on Ethereum by Total Value Locked (TVL) according to DeFi Pulse (at the time this article was written).

Uniswap kicked off an incredible surge of enthusiasm and activity on Ethereum because it makes it so easy to trade tokens. It’s trustless nature also provides significant security benefits because you don’t have to trust anyone with your tokens. However, Ethereum’s high transaction fees (called ‘gas’ fees) made it prohibitively expensive to use during times of congestion.

The QuickSwap team’s goal was to leverage the low fees and rapid confirmation times of Polygon’s Layer 2 technology, so they modified Uniswap (an open-source dApp) to run on Polygon and named the resulting project QuickSwap. Like Uniswap, QuickSwap has a native token called QUICK. QUICK may be purchased via the QuickSwap exchange with ETH or other tokens, or it can be awarded to liquidity providers.

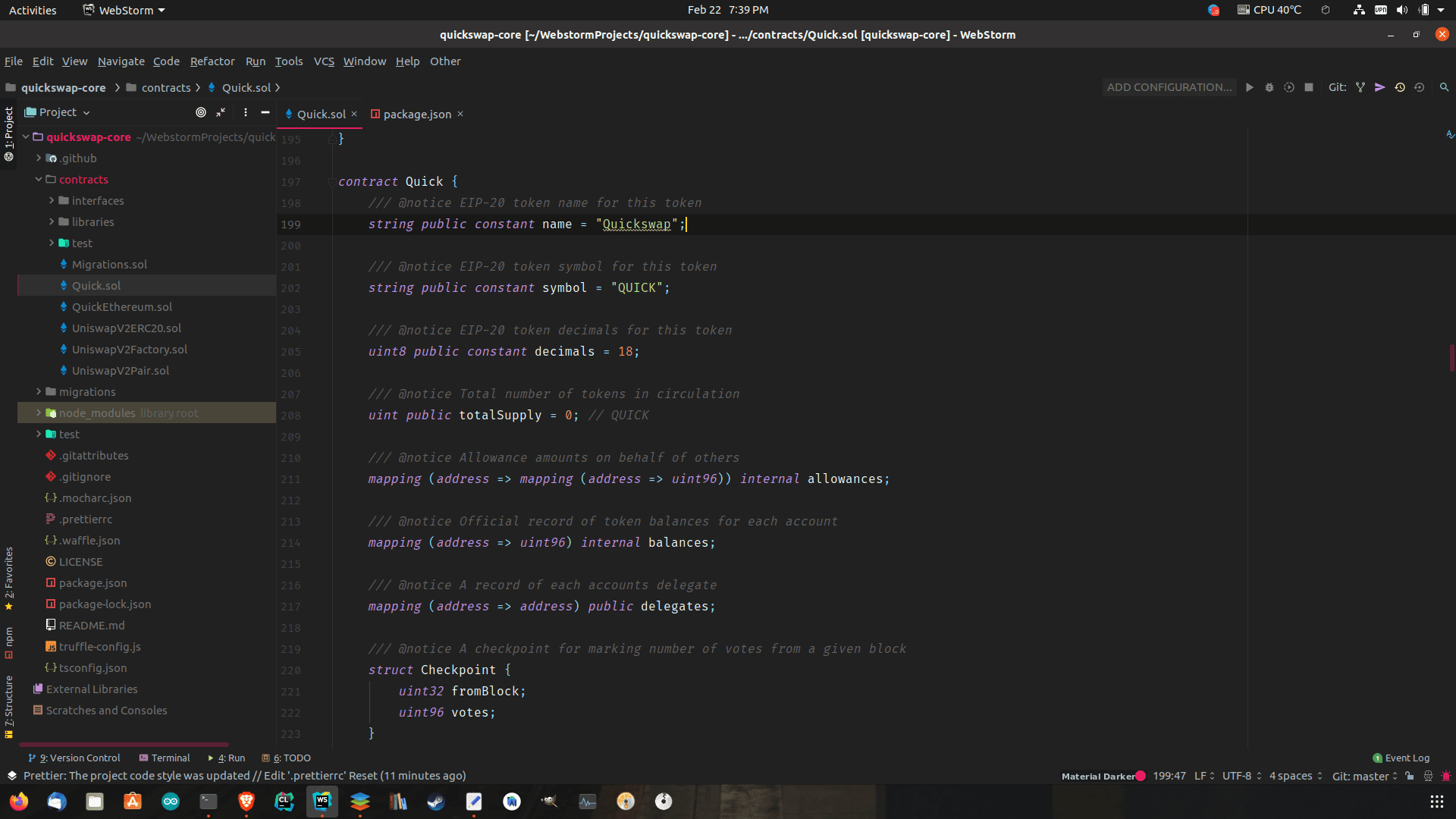

QuickSwap is also open-source. Open-source software facilitates a significantly higher degree of accountability and is more auditable than proprietary software. This is important, considering that QuickSwap handles users’ funds. If you’re interested, you can view its source code on GitHub and even contribute to it! (by pitching a suggestion)

The image above is a small portion of QuickSwap’s source code — more specifically the smart contract named ‘Quick’. There are several other smart contracts, which perform various functions. QuickSwap is written primarily in the Solidity programming language and Typescript (a JavaScript-like language). Solidity is the language used to write Ethereum smart contracts.

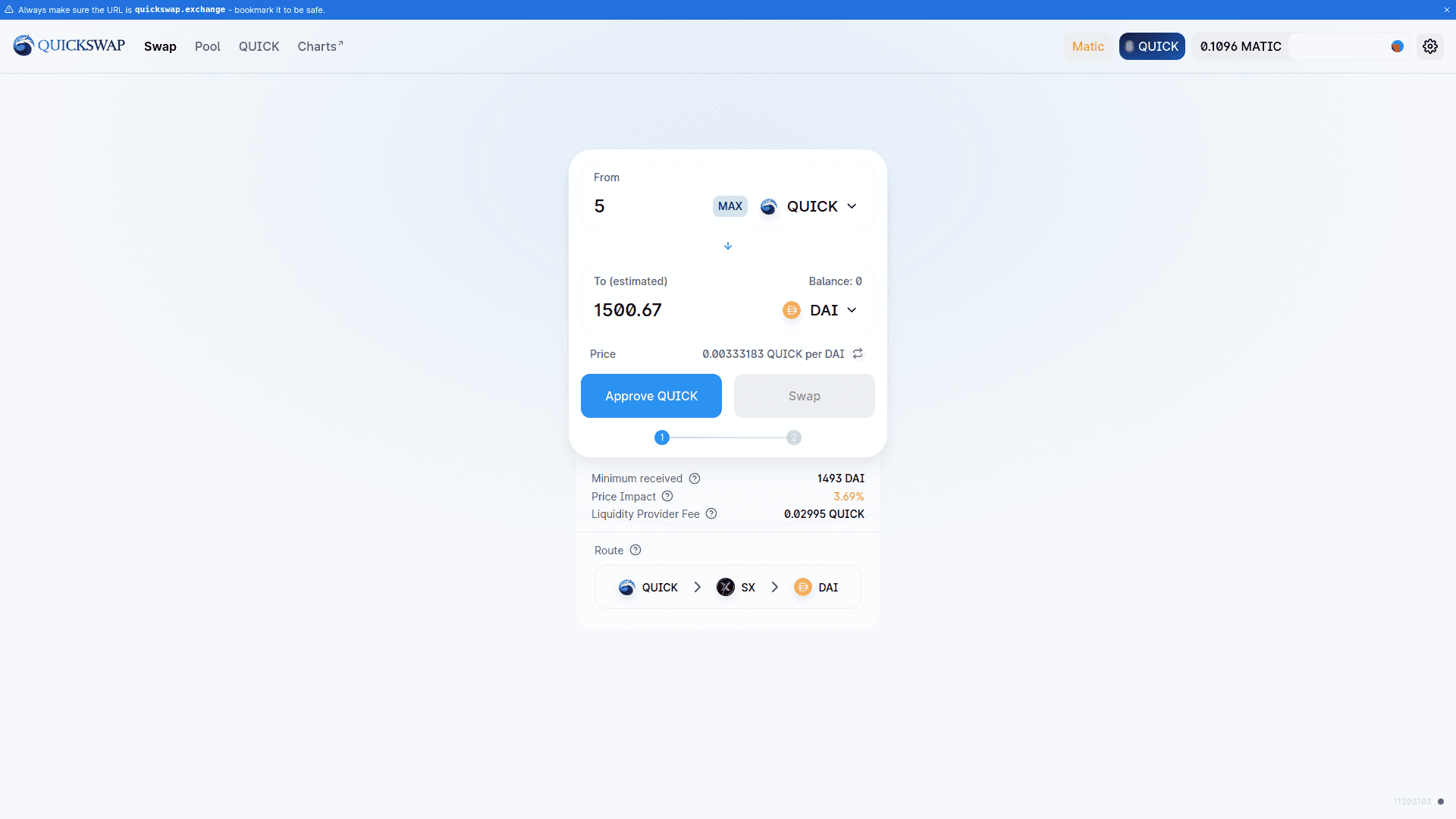

Routing: Finding The Best Price For Your Trade

QuickSwap incorporates the ability to carry out a sequence of multiple token swaps in order to take advantage of the best possible price for your trade. For example: For a previous exchange, it traded QUICK > SX > DAI in order to convert my QUICK tokens to DAI at the best possible price. You don’t have to do any of this yourself, it chooses the best route for you and executes the trades automatically.

Price Impact Warnings

QuickSwap provides price impact warnings at the bottom of your trading dialog once you have selected your trading pair and the amount that you’re trading. This is a useful heads-up that tells you the difference between the market price and the estimated trade price. That difference is determined by the size of your trade. It also allows you to set a price impact limit in order to cancel your trade/limit your losses if it is too high.