Decentralized finance (DeFi) has grown to a multi-billion dollar industry in only a few years. It demonstrated that its possible to fully automate trading and loan platforms in a secure fashion. However, these platforms can only use cryptocurrencies as collateral. Cryptocurrencies have been catching on around the world, but haven’t tapped into the traditional loan market in which physical assets are used as collateral.

The traditional loan market is staggeringly large, with millions of people taking out loans and using assets such as their homes as collateral. Cryptocurrency and DeFi are electronic in nature. However, the banking system has shown us that the transfers of physical assets such as cash can be done electronically.

Physical Assets As Collateral In DeFi

The rise of tokenization has helped lead to the creation of projects such as Persistence.one. Persistence is a decentralized finance protocol that bridges the inherently digital world of DeFi with the traditional loan market. It does so by enabling people to use physical assets as collateral on decentralized finance platforms.

This means that you could borrow cryptocurrency and use a physical item as collateral. The highly transparent nature of blockchains provides significant value in this area because a blockchain is ideal for tracking loans, payments, and everything else occurring on the network. Smart contracts play a crucial role in making this work because they can execute the terms of an agreement if certain conditions are met.

This combination of qualities makes blockchains highly auditable. Decentralized blockchains provide immutability to prevent tampering, and their distributed, replicated nature means that data loss is extremely unlikely. They also safeguard against data corruption thanks to the use of hashing and checksums.

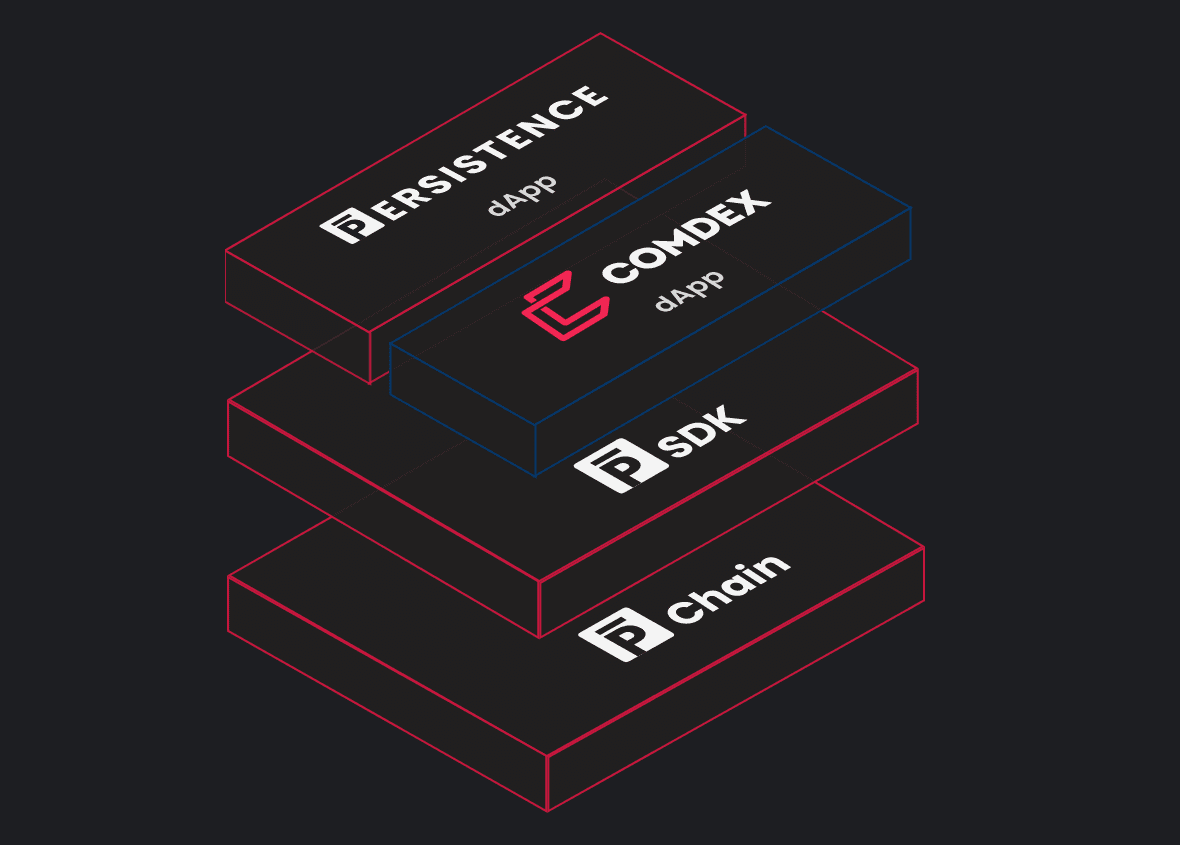

Persistence.one uses a layered approach to achieve physical asset tokenization. Layers include the Persistence chain, Persistence SDK, Comdex dApp, and the Persistence dApp.

Persistence Chain: The Persistence chain is a natively interoperable blockchain that serves the purpose of verifying and logging transactions in an auditable fashion.

Persistence SDK: The Persistence SDK is a software development kit that enables developers to tokenize real-world assets, facilitate decentralized exchanges, and to facilitate financing against tokenized assets. Like the Persistence chain, the Persistence SDK handles the digital side of things.

Comdex dApp: The Comdex dApp is an institutional application that provides users with trade discovery, trade settlement, trade financing, and end-to-end commodity trading capabilities.

Persistence dApp: The Persistence dApp enables cryptocurrency lenders and investors to provide liquidity to the network.

Initial Token Distribution Mechanism

Persistence uses the XPRT token for staking, on-chain governance and to cover the cost of running the network. The XPRT token was distributed via a StakeDrop initiative. The StakeDrop refers to the distribution of XPRT tokens to stakers on participating cryptocurrency networks such as Cosmos, Kava, Tezos, among others.

This was done at no cost to the recipients. The StakeDrop strategically rewarded people who have staking experience with the XPRT tokens. This helped the Persistence network to start off with the most experienced (and dedicated) stakers possible.

pSTAKE

The Persistence developers also created pSTAKE, a liquid staking mechanism which helps to bridge the many opportunities offered by decentralized finance. pSTAKE enables users to stake a token from one cryptocurrency network and then issues liquid tokens pegged to the value of that. Those liquid pegged tokens can then be reinvested elsewhere (even on other cryptocurrency networks) to earn additional yields. For example: You can stake ATOM, get paid staking rewards and earn interest on loans simultaneously.

What is the relationship between Cosmos, Tendermint, and Persistence?

Tendermint (also referred to as Tendermint Core) is a BFT consensus engine and validator node software. It is blockchain agnostic, meaning that it can be used to serve as a node for any Cosmos SDK-based software.

Cosmos SDK is a software development kit that provides the tools to build decentralised apps, which can be powered by the Tendermint consensus engine. Cosmos SDK apps are written in the Go programming language (Golang).

Persistence is a platform built with Cosmos SDK, and it utilises Tendermint Core as a consensus engine.