Decentralized exchanges (DEXes) have revolutionized trading by facilitating currency trades via non-custodial wallets, and eliminating the complex registration process that traditional centralized exchanges entail. However, getting your desired buying/selling price is not easy on decentralized exchanges. This makes it more difficult to turn a profit on your trades.

Limit orders have made centralized exchanges more convenient and profitable than DEXes because you can submit an order to buy or sell a token only if it falls or rises to your desired price. This feature is now available on the QuickSwap DEX! With low Polygon transaction fees, liquidity mining, and limit orders DEXs are now competing with centralized exchanges.

To take advantage of limit orders in QuickSwap, go to the limit order page on the official QuickSwap website. Read the QuickSwap introduction first to familiarize yourself with the interface if you need to.

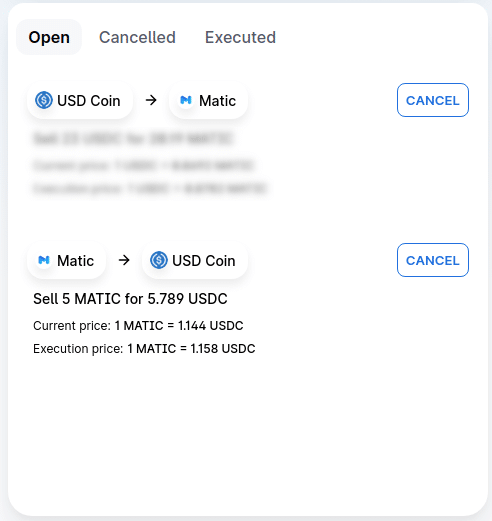

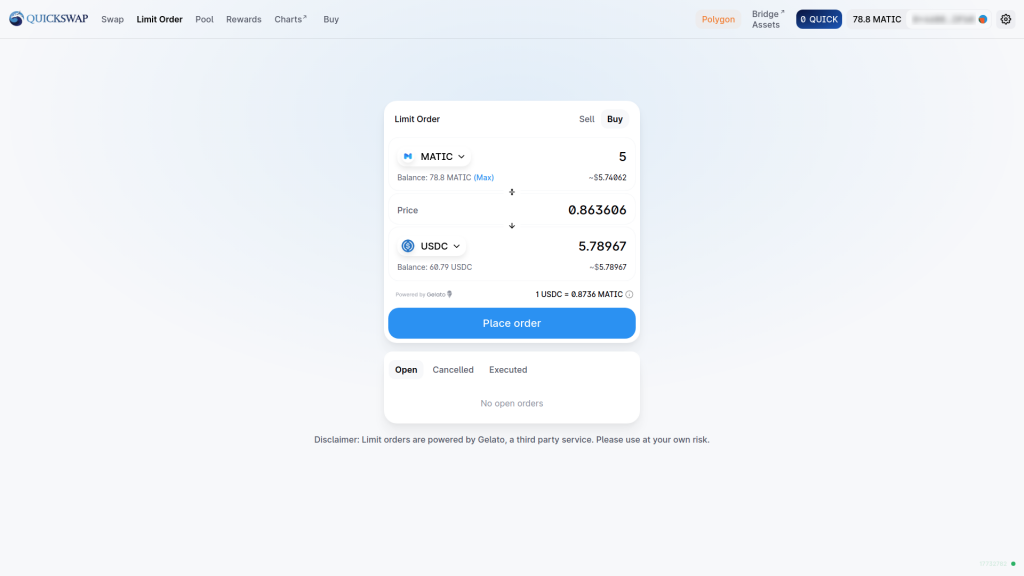

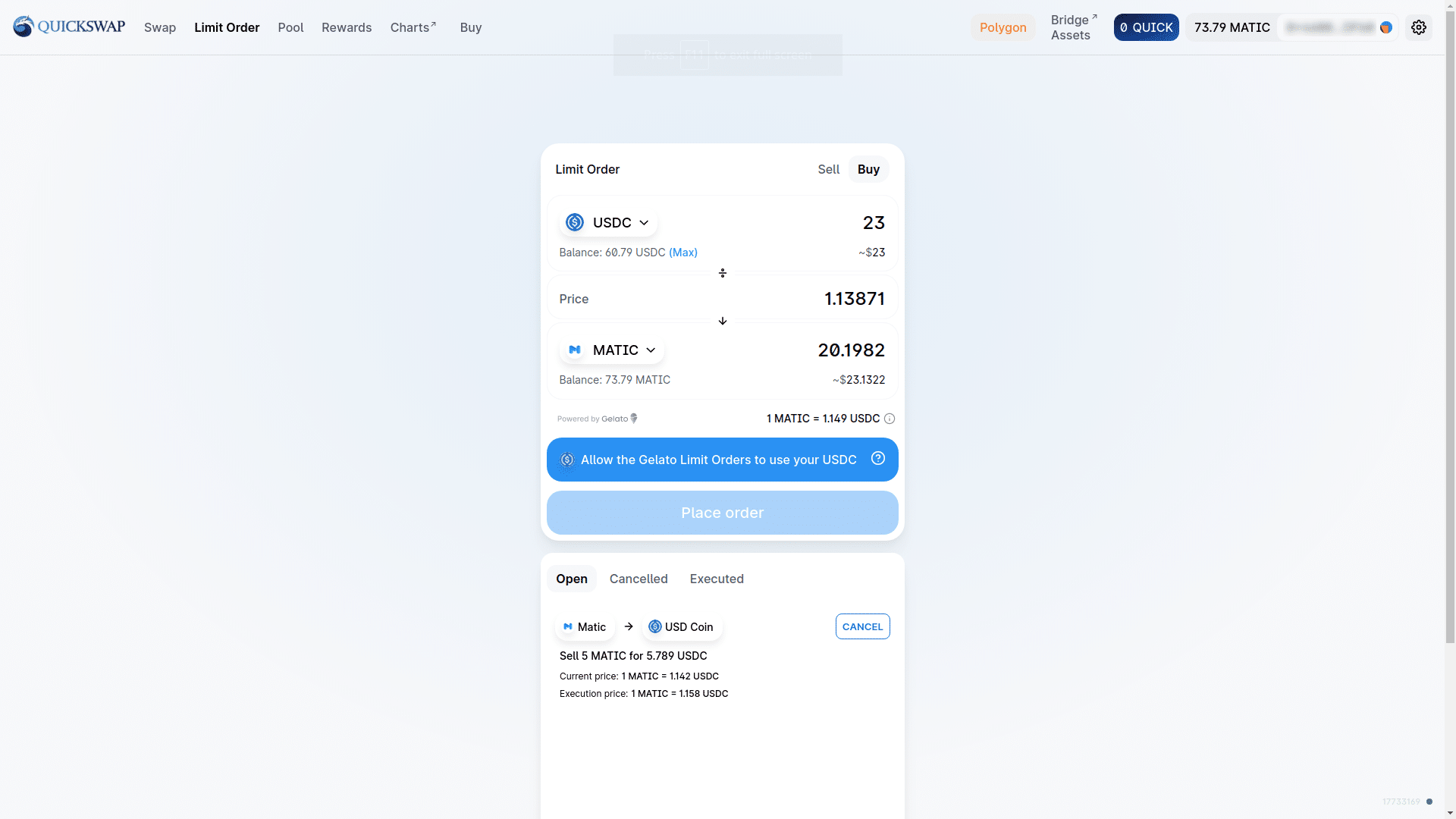

Select ‘Buy’ in the top right hand corner and the currency you wish to buy in the second drop down box and select the one you want to trade for it in the first dropdown box. Set your preferred exchange rate in the Price field and click ‘Place Order’:

Note that trading certain tokens may require an additional approval step. For example: Trading USDC for MATIC. In such a scenario, click ‘Allow the Gelato Limit Orders to use your USDC’ and then MetaMask will prompt you for confirmation. Click ‘Confirm’ in MetaMask and wait a moment, then you’ll be able to click ‘Place Order’ to continue.

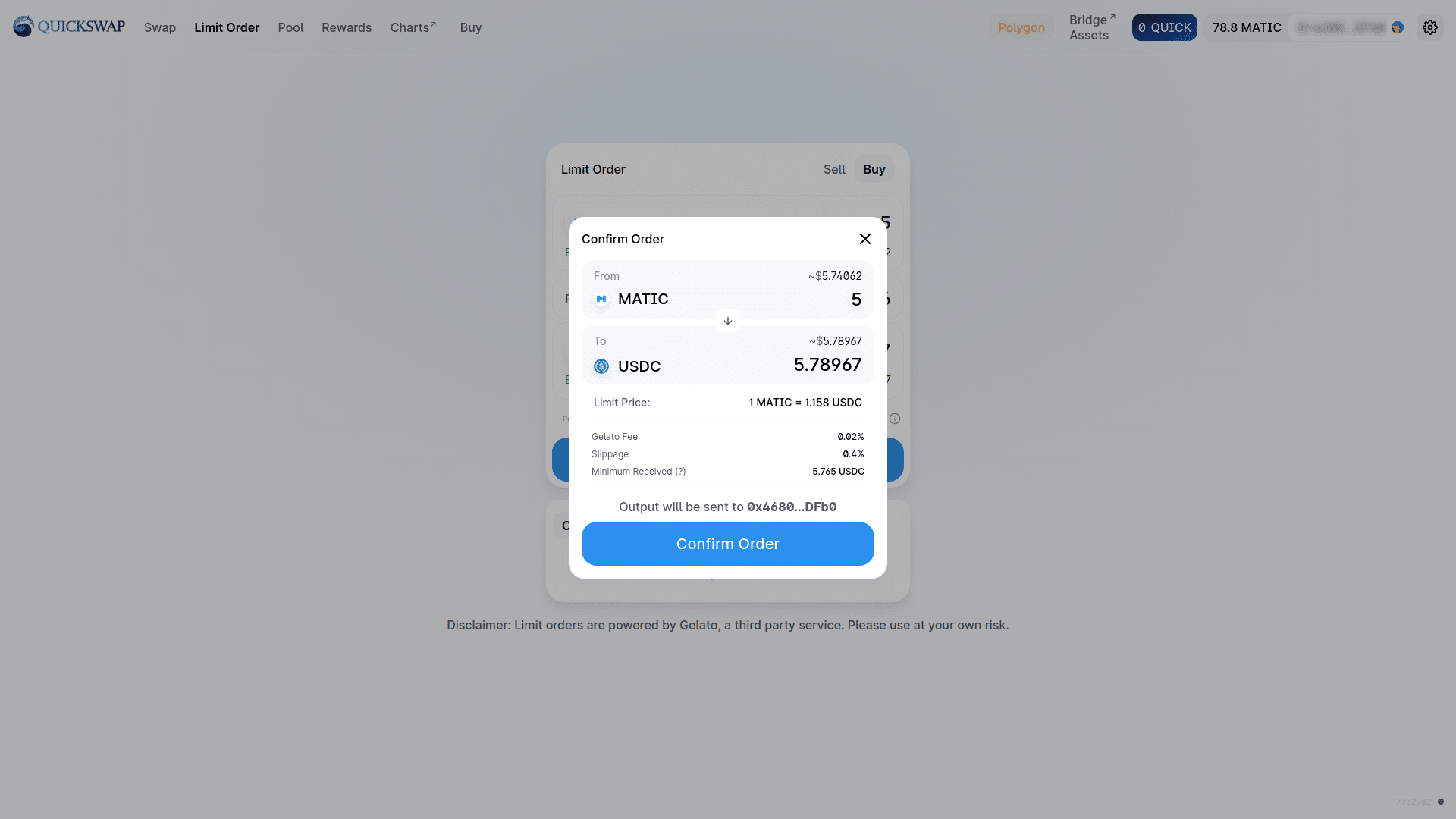

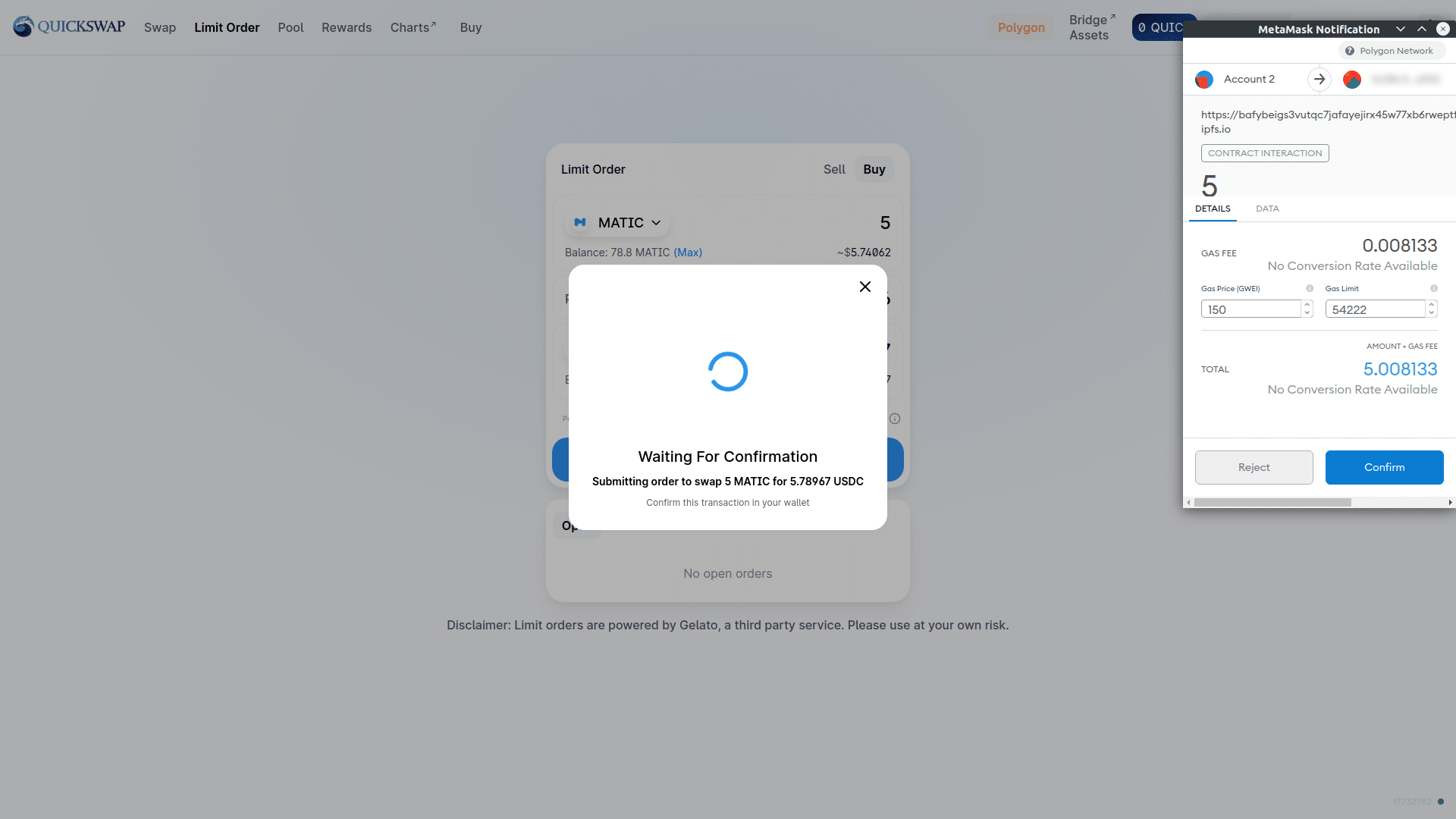

Next you’ll get a MetaMask confirmation, review it and click ‘Confirm’:

The process for buy orders is almost identical. This means you can just click ‘Sell’ if you want to sell a token you have for another, and select the one you want to trade in the top drop-down box, and select the token you want to receive in the second drop-down box. The rest of the steps are the same.

QuickSwap limit orders are powered by Gelato — an automation layer that helps blockchain projects implement complex functionality on Ethereum among other platforms. Gelato has also been audited by Certik.