Australian data center provider Iris has doubled its fundraising round to $40 million AUD ($30.7 million USD) ahead of its Initial Public Offering (IPO). The company provides data center services for computing applications requiring high performance and efficiency, such as machine learning, genomics and research, rendering and visualization, mining, and more. They do so using sustainable energy sources such as solar and wind farms.

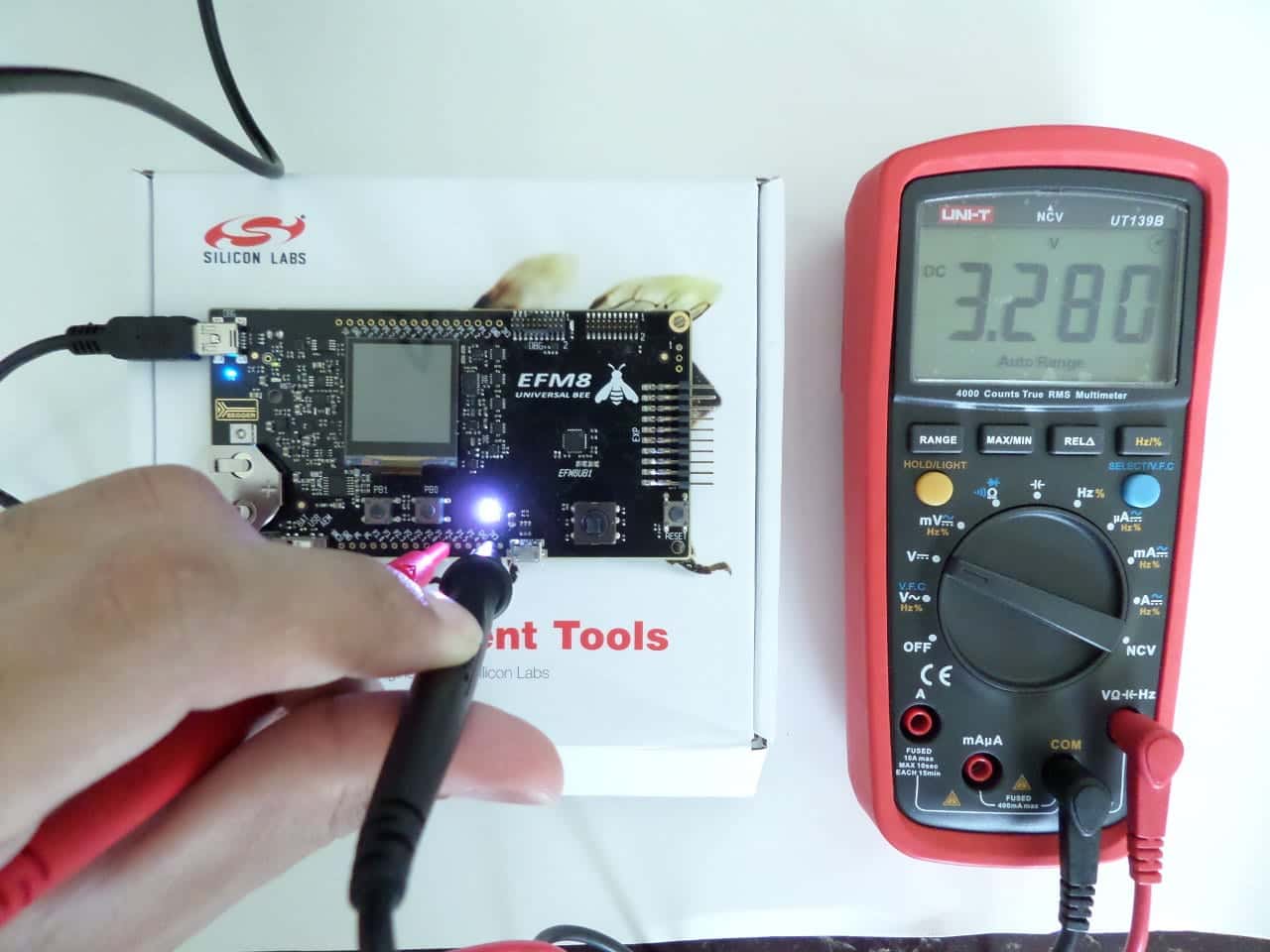

Bitcoin mining is known for its high energy usage due to its competitive nature. Mining difficulty is something that increases with the amount of hash power online — this means that more miners (and/or more powerful mining setups) will cause Bitcoin’s algorithm to increase mining difficulty. This sounds absurdly inefficient and costly. However, it makes it harder to take over the Bitcoin network (it also makes it harder to steal coins from users). Bitcoin currently stands as one of the most difficult networks to take over.

For a store of value in which security has to be a top priority, how do you ameliorate the resulting environmental impact of its high power consumption? Using cleaner energy sources is the most actionable solution in the long term considering that more efficient mining rigs just end up increasing mining difficulty (because they lead to more mining). The top Bitcoin mining companies hold a combined 38,903 BTC, which is only 0.18% of Bitcoin’s limited supply of 21 million BTC. That is significantly less than MicroStrategy’s Bitcoin holdings, which equate to 158,400 BTC.

Aside from that, the world should be trying to reduce reliance on polluting energy sources — so this makes perfect sense. Iris Energy’s solar and wind energy-powered mining services will help to offset the indirect coal and gas usage of mining operations. If this business model succeeds on a large scale, it could also bolster the renewable energy industry. That could lead to increased production, more funding for the solar and wind power industry, and reduced renewable energy prices due to economies of scale.